Lately, I’ve heard too much that Bretton Woods system was abolished on August 15, 1971 upon the USA proclaimed default, having refused to exchange dollars for gold, that I’ve become bored. But as I always talk specifically about the Bretton Woods model everywhere, it’s high time to explain the situation in more or less detail

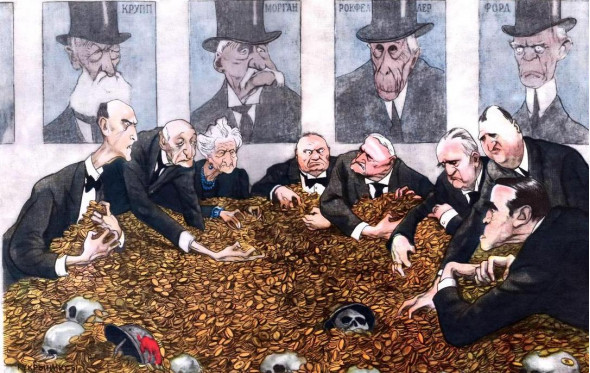

So, in 1913 the USA adopted the law «On Federal Reserve» to provide control over emission and currency circulation on the part of private individuals (beneficiaries of the banking system). Particularly this moment may be considered the final point of global «Western» project formation which at that moment was still at the network phase.

By the way, I’m going to immediately respond to all the critics that the FRS is allegedly a state structure as it’s Chairman is appointed by the USA President (on the Congress approval). In reality the FRS top management consists not only of pre-approved members, but also of rotated chairmen of reserve banks’ boards (12 in total), who make more than half of FRS Management Board. And reserve banks are privately owned, thus, the state is not a majority stockholder.

At that time the dollar was gold-pegged (as we can see, it’s far from Bretton Woods model’s specifics), thus, it was difficult to emit it unrestrictedly to meet the bankers’ needs. That’s why during the «Great» Depression another scheme was used, which allowed to redistribute assets to benefit the bakers who could obtain unlimited credits (under money shortage circumstance). They got the credits, took up interesting assets and then FRS washed the excess liquidity off the money market. In other words, FRS, in fact, levied a special tax on all depositors to the advantage of its beneficiaries.

However, at that moment the financiers’ share in assets redistribution was limited to no more than 5% of its total volume. The problem was, the bankers needed emission, and to get it, the Bretton Woods system was devised as an excellent instrument. The idea was simple: the dollar had to become the major world currency and substitute for all the regional currencies in reserves and circulation. That’s why the Bretton Woods reform of the world finance was carried out.

At the first stage the reform concerned only the Western countries (the USSR participated in the conference, signed the documents but never ratified them, and in 1950 the ruble stopped being dollar-pegged to the credit of gold). But as a result, an immense resource for dollar emission (the dollar’s sphere of circulation was rapidly expanding) was generated which allowed FRS beneficiaries to legalize that emission as their profit.

The economic substance of this operation was in the fact, that the whole Western Europe (where the process of dollar transformation into the main world currency began) was all mount of broken bricks in 1945. And even if the plants were built (and they were being built then), there was nobody to purchase the products. And the trick was, not only Marshall plan (i.e. dollar investments) but also the USA markets were open for West-European countries. That allowed Western Europe to gain profit, sell their products but for dollars only!

In consequence, they could start emitting national currencies pegged to the dollar (named the «euro-dollar» then) under surveillance of Bretton Woods institutions, IMF, World Bank and GATT (which then changed its name to WTO), and to pay salaries with these currencies providing for home demand. But this model could work only because by that time the USA production and consumption ratio in the world had extended 50%.

Then this model was reapplied to Japan and Taiwan (after 1949 proclamation of socialistic PRC), to South Korea, Hong-Kong and, finally, to China. By the way, it’s incorrect to compare growth of China and the USSR: if the USSR had then gained entry to the USA market, its growth would have been tremendous. But neither the USSR, nor Russia got entry to the USA market.

Upon the 1970th slump (having come out of exhaustion of all potential spheres of the dollar expansion simultaneously with growth of financial sector share in the assets redistribution in the USA up to 25%) the beginning of «reaganomics» finalized the shape of Bretton Woods model.

From then on it looked like this. On the one hand, transnational banks, for account of the emissive dollars, invested into countries with cheap labor force to manufacture low-cost products. On the other hand, for the account of the same emissive dollars, they credited private demand in the USA (and other western countries) which allowed a tremendous rise in the standard of living and formation of middle class dominating in social system. It formed a settled behavioral pattern of mass consumption.

From 1981 to 2008 an average debt of an American household increased from 60-65% to more than 130% with respect to really disposable income. Moreover, cost of providing service as to such debt was constantly being reduced because cost of credit was declining (FRS discount rate for the same period was reduced from 18% to almost 0%). At the same time buying capacity of an average salary remained at the level of 1950th. Though the financiers’ share in assets redistribution for their benefit grew up to 50% (and was even higher at certain times).

By 2008 the situation had become critical: citizens of «well-developed» countries spent steadily more than they earned, private debts were egregious and impossible to refinance under low credit rates. Bretton Woods system came to a standstill. By the way, please note that this system is absolutely unrelated to currency exchange regulation.

Nevertheless, Bretton Woods institutions (such as IMF, WTO, World Bank, affiliated credit-rating agencies, consulting and auditing companies) continue to demand abidance by their regulations. In particular, cash withdrawal from the Russian economics (the so-called «budget regulation» binding the country to export all extra profit on sale of petroleum at a rate higher than a certain world rate), ban on restriction of currency speculations, restrictive monetary politics – all these are IMF requirements.

This system’s trouble is that it fails to provide economic growth in the world. Monetary emission no longer causes the rise, moreover, world funds haven’t turned over for more than 10 years. This wouldn’t make bankers worry unless they had control over an emission institution, but Bretton Woods reform of world finance in 1944 was incomplete and FRS remained under national jurisdiction. Bankers have been trying to change the situation for all these years, in particular, in 2011 but they haven’t succeeded (inter alia, due to the famous «Strauss-Kahn case»). And today new President Trump is vigorously trying to master FRS top management and to push them beyond the bankers’ nominal control.

All in all, it’s safe to say that by now Bretton Woods world finance system has passed on and the main question is what the new model is going to be. But this is a subject of an article-to-be.